Victory Community Credit Union Banking Changes

Changes to VCCU Online Banking & Debit Cards

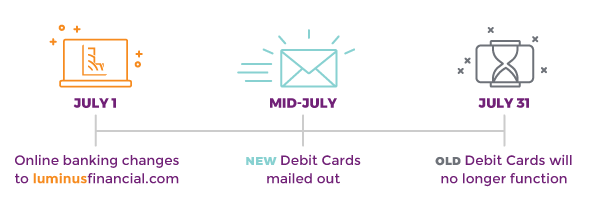

Over the next month, three important updates will be happening that Victory Community Credit Union (VCCU) members need to know about.

- Access to online banking will switch to luminusfinancial.com.

- Account types and features will be updated to comparable Luminus Financial products.

- All VCCU members will be receiving new debit cards.

1 - Online Banking Login

On July 1st, VCCU members who use online banking will be required to log in via the Luminus Financial website (www.luminusfinancial.com). We recommend bookmarking the Luminus homepage to make access to online banking even easier. Mobile banking users can also use our Mobile Banking App available for both iOS and Android devices to access funds and information on the go.

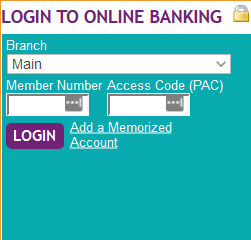

How To Log In

You will be able to log in to online banking by using the menu at the top right of all Luminus Financial website pages. From there, you will be taken to your familiar banking platform.

- Select Victory from the drop down menu.

- Enter Member Number

- Enter Password (Personal Access Code)

- Press “LOGIN” or Enter

2 - Updated Member Accounts

As of July 1, you will notice that your accounts have been updated to match the closest account or product offered by Luminus Financial. Please review our Products and Services to better acquaint yourself with our full offering and applicable fees. If you have questions about what will change, please call our Member Relations Officers at 416-366-5534 or toll free at 1-877-782-7639.

3 - New Debit Cards

This July, all VCCU members will also be receiving new Luminus Financial Debit Cards. Your new card will have improved features such as Interac Flash to provide a safe, convenient way to pay for purchases up to $100. Please note that you will be required to activate your card before its first use.

As of July 31st, current debit cards will be deactivated and will no longer work. If you have not received your new card by July 31, 2018 please call our Member Relations Officers at 416-366-5534 or toll free at 1-877-782-7639.

Update Your Address - Win $250

Do we have your most up-to-date contact information? Call your branch and provide your most current information and you will be entered to win a $250 gift card of your choice!

If you have any questions about these changes, please call our Member Relations Officers at 416-366-5534 or toll free at 1-877-782-7639.

Frequently Asked Questions

Q: When is the Conversion Date?

A: July 1, 2018

Q: Will the two branches remain open?

A: Both Branches will remain open and will be accessible to all Luminus Member-Owners. The Financial Hub @ 1 Yonge will also be available to VCCU Members, including access to Interchange Financial Currency Exchange, CWP Financial Services, use of the Boardroom, free WiFi and Community Events.

Q: Will the hours of operation change?

A: The Yonge Street location will be open from 8:30 AM until 6:00 PM, Monday through Friday. The Weston location will be open from 10:00 AM until 4:00 PM, Monday through Friday.

Q: When does the VCCU website transfer to the Luminus Website?

A: As of July 1st, VCCU Members will be redirected to the Luminus website and online banking.

Q: Will previous UB Vendor and Account Number Information from VCCU be available to Members through online banking after conversion?

A: Yes, this information will be transferred over as part of the Conversion, and will be available online and through RFS.

Q: Will Interac e-Transfers be available to VCCU Members?

A: Yes, a new feature available through online banking for VCCU members will be interac e-transfers.

Q: Are there limits on how much can be sent or received?

A: While there are no minimums – you can send any amount above $0 – there are maximums for both sending and receiving Interac e-Transfers.

Q: Will VCCU Members be able to make cheque deposits from their phone?

A: Yes, with the Luminus Financial Mobile App, you can capture an image of your cheque and deposit it into your account from virtually anywhere using your hand-held device. An Automatic Hold will be placed on all Remote Deposits.

Q: Will auto bill payments, auto transfers from one account to another and Target GICs continue?

A: Scheduled Bill Payments can now be set up by Members through online banking. Auto Transfers between accounts will continue, as the information will be transferred over upon Conversion. Target GICs will no longer be offered, however an automatic transfer can be set up to credit a new Investment Savings Account.

Q: How will VCCU Member-Owners be reset for online banking access, through MemberDirect?

A: After logging into your MemberDirect Authentication Admin Portal, staff members will use the prefix “br5acct” followed by the Member Number to access the profile status. Staff Members will then be able to view the status history, unlock or unenroll Access.

Q: Will VCCU Membercards continue to work after Conversion?

A: All Luminus and VCCU Members will be receiving a new Luminus Membercard. The new cards will include Interac Flash which is an easy and safe way to pay for purchases up to $100.

Q: Will “save it up” transfers continue on POS transactions?

A: The “save it up” feature will no longer be available after conversion, however an automatic transfer can be set up to help Members save.

Q: Will Service Fees be increasing for VCCU Members?

A: Some Services Fees will be increasing, however with many new services available to VCCU Members, they will now have more options when accessing funds to help avoid service fees and make their Banking easier than ever.

Q: Will VCCU Members have changes to their Account Types, after Conversion?

A: Yes, VCCU Members will now be set up with a Luminus Personal 1 Chequing Account and/or Plan24 Savings Account. Members will also be able to take advantage of the ThreeStar or Fivestar Chequing Package, with a Payroll Deposit as well as the Investment Savings Account.

Q: Will VCCU Members continue to receive Paper Statements?

A: All Members will be automatically switched to receive Electronic Statements, however can be set up to receive Paper Statements Monthly, Quarterly or Annually (fee applicable).